Strategies for Cost-Effective Offshore Company Formation

When considering overseas business development, the quest for cost-effectiveness ends up being a critical problem for services looking for to broaden their procedures globally. In a landscape where fiscal prudence preponderates, the techniques employed in structuring offshore entities can make all the difference in achieving monetary effectiveness and operational success. From browsing the intricacies of jurisdiction selection to carrying out tax-efficient frameworks, the journey in the direction of establishing an offshore existence is raging with obstacles and chances. By exploring nuanced methods that blend legal compliance, monetary optimization, and technological developments, companies can get started on a course in the direction of overseas company development that is both economically sensible and tactically noise.

Choosing the Right Jurisdiction

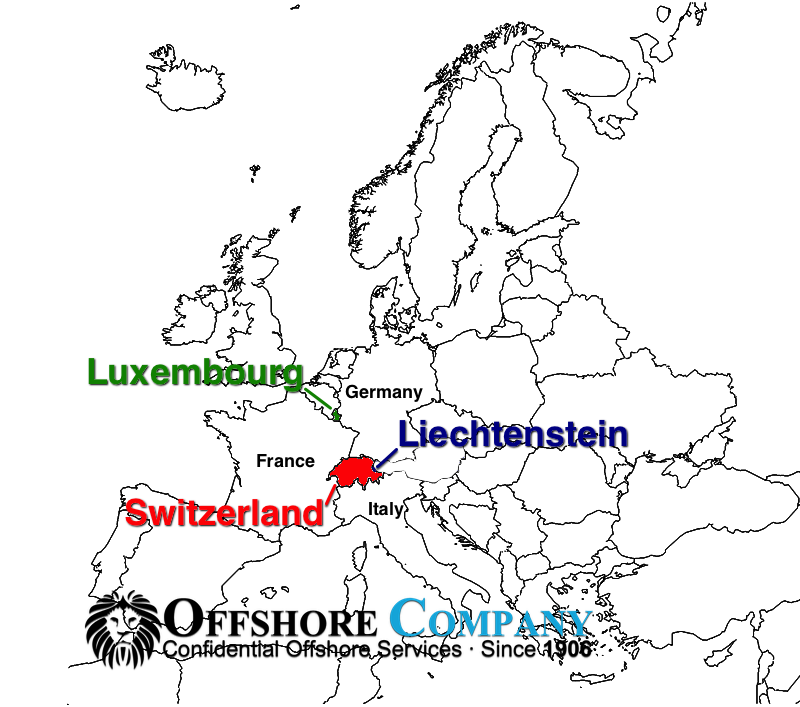

When establishing an overseas company, picking the ideal jurisdiction is a vital decision that can dramatically affect the success and cost-effectiveness of the formation procedure. The territory chosen will certainly identify the regulative framework within which the business operates, impacting tax, reporting requirements, personal privacy regulations, and total service flexibility.

When selecting a jurisdiction for your overseas company, a number of aspects have to be considered to make sure the choice lines up with your strategic objectives. One crucial facet is the tax routine of the territory, as it can have a considerable impact on the company's productivity. Additionally, the degree of regulatory conformity called for, the political and financial security of the jurisdiction, and the simplicity of operating must all be evaluated.

Moreover, the credibility of the territory in the international company community is important, as it can affect the perception of your business by customers, partners, and financial establishments - offshore company formation. By very carefully analyzing these variables and seeking professional guidance, you can choose the appropriate territory for your overseas firm that maximizes cost-effectiveness and sustains your company objectives

Structuring Your Business Effectively

To make certain optimum efficiency in structuring your overseas business, careful focus must be given to the business structure. By establishing a clear possession structure, you can make sure smooth decision-making procedures and clear lines of authority within the business.

Next, it is necessary to consider the tax effects of the selected structure. Different territories offer varying tax obligation benefits and rewards for overseas companies. By thoroughly evaluating the tax legislations and laws of the selected jurisdiction, you can enhance your company's tax obligation efficiency and minimize unneeded costs.

In addition, keeping proper documentation and records is crucial for the efficient structuring of your offshore business. By keeping up-to-date and exact documents of monetary deals, business choices, and conformity files, you can guarantee openness and responsibility within resource the company. This not just helps with smooth operations however additionally aids in showing compliance with governing demands.

Leveraging Innovation for Savings

Efficient structuring of your offshore firm not only pivots on thorough attention to organizational structures but additionally on leveraging technology for savings. One way to take advantage of technology for cost savings in offshore company development is by using cloud-based services for data storage space and collaboration. By integrating innovation strategically right into your overseas business development procedure, you can attain substantial savings while boosting operational effectiveness.

Reducing Tax Obligation Liabilities

Using tactical tax preparation techniques can effectively decrease the monetary concern of tax responsibilities for offshore business. Among one of the most usual techniques for reducing tax liabilities is via revenue moving. By dispersing revenues to entities in low-tax jurisdictions, offshore companies can lawfully decrease their overall tax obligation commitments. Additionally, making the most of tax obligation rewards and exemptions provided by the territory where the offshore business is signed up can result in considerable financial savings.

One more method to lessening tax liabilities is by structuring the offshore company in a tax-efficient fashion - offshore company formation. This involves thoroughly designing the possession and functional structure to maximize tax benefits. Establishing up a holding company in a territory with desirable tax regulations can help minimize and settle revenues tax obligation exposure.

In addition, remaining updated on international tax obligation guidelines and compliance needs is vital for reducing tax obligations. By guaranteeing stringent adherence to tax obligation laws and laws, offshore companies can prevent pricey charges and tax obligation conflicts. Looking for expert advice from tax specialists or lawful experts focused on worldwide tax matters can additionally supply Website beneficial insights right into effective tax obligation preparation strategies.

Ensuring Compliance and Danger Mitigation

Executing durable conformity measures is essential for offshore companies to alleviate threats and keep regulatory adherence. Offshore territories typically deal with enhanced analysis because of problems pertaining to cash laundering, tax obligation evasion, and other monetary crimes. To make certain compliance and alleviate risks, overseas companies must perform detailed due diligence on clients and company companions to prevent participation in illicit activities. In addition, applying Know Your Consumer (KYC) and Anti-Money Laundering (AML) procedures can help validate the legitimacy of transactions and safeguard the business's credibility. Routine audits and reviews of financial records are critical to identify any irregularities or non-compliance issues immediately.

Additionally, remaining abreast of transforming policies and lawful demands is vital for overseas business to adapt their conformity methods accordingly. Involving legal experts or compliance experts can offer important support on navigating complicated governing landscapes and ensuring adherence to global standards. By focusing on conformity and risk reduction, overseas firms can improve openness, construct trust fund with stakeholders, and secure their operations from potential lawful repercussions.

Verdict

Using tactical tax obligation preparation methods can successfully reduce the monetary burden of tax obligation responsibilities for overseas companies. By dispersing profits to entities in low-tax jurisdictions, overseas companies can legally decrease their general tax obligation commitments. Furthermore, taking advantage of tax motivations and exceptions provided by the jurisdiction where the offshore company is registered can result in significant financial savings.

By making sure stringent adherence to tax legislations and policies, overseas firms can stay clear of expensive charges and tax obligation conflicts.In conclusion, cost-efficient offshore business formation calls for mindful consideration of territory, efficient structuring, technology application, tax obligation reduction, and compliance.