A Biased View of Federated Funding Partners Legit

Table of ContentsSome Of Federated Funding Partners ReviewsA Biased View of Federated Funding Partners LegitThe Main Principles Of Federated Funding Partners The Ultimate Guide To Federated Funding PartnersThe Buzz on Federated Funding Partners LegitThe Best Guide To Federated Funding Partners Reviews

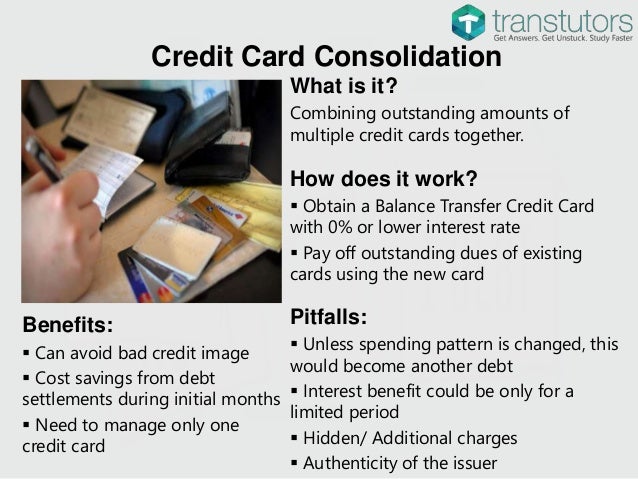

Here's what you need to know about debt combination: What are the advantages of financial debt loan consolidation? Long-term financial obligation with a high rate of interest price can set you back thousands of bucks in passion settlements over the life of the funding.

If you have actually been falling behind on your regular monthly payments, moving your numerous financial debts to a solitary low-interest funding can assist to boost your rating. Moving debt to a brand-new financing can occasionally entail prolonging the term of the car loan.

Some Ideas on Federated Funding Partners You Need To Know

If overspending as well as untrustworthy cash management is what landed the debtor in financial obligation in the initial place, combining debt on its very own will certainly not solve the issue. Lots of reduced- or no-interest credit history cards just supply these features as a momentary promo.

How can I consolidate my financial obligation? You have a number of choices for financial debt consolidation, each with its own pros and cons. Personal Finance or Credit Line (PLOC): Obtaining an unsecured lending from Abilene Teachers FCU will enable you to pay off all your exceptional finances quickly and also relocate your debts into one low-interest funding (federated funding partners).

Also, since they're unsecured, the passion prices on these financings can be high. Fortunate for you, though, as a member of Abilene Teachers FCU you have accessibility to individual financings or credit lines without any origination costs and also rates of interest as reduced as 7. 75% APR *. Examine out all our choices! Home Equity Loan (HEL): A house equity car loan uses your residence as collateral for a fixed-term lending.

Federated Funding Partners Reviews Fundamentals Explained

As safeguarded debt, rate of interest on HELs will certainly be inexpensive and also might offer you with considerable cost savings. Passion on house equity financing items is typically tax-deductible.

You may just wish to consolidate your different lines of debt. As opposed to trying to master all those numbers in your head or creating an impressive spread sheet, you could simply wish to combine your various credit lines. Debt debt consolidation is when you integrate existing financial obligations into a new, solitary finance.

What Is Financial obligation Consolidation? Financial debt debt consolidation is actually rather understandable. It's when you get one car loan or line of credit score and utilize it to settle your various debtswhether that's trainee finances, automobile lendings, or bank card debt. It combines all of those existing financings into one financing, which suggests you go from having a number of monthly payments and also different rate of interest to just one.

Indicators on Federated Funding Partners Bbb You Should Know

Debt relief programs can assist you combine your financial obligation, however they aren't obtaining you a brand-new loanit's only combination. While you are able to consolidate several kinds of financings, the process for consolidating pupil loans is various. Keep reading to comprehend exactly how they are various. Obtaining a Financial Debt Combination Funding When choosing a debt consolidation finance, look for one that has a rates of interest and terms that match your general financial image.

When you use and also are approved for a financial debt consolidation loan, it might take anywhere from a few days to a week to get your money. Occasionally the lenders will pay your debts off straight, various other times they will send you the loan money, my link as well as you'll pay the financial debts off yourself.

Financial debt combination financings have a tendency to come with reduced rate of interest rates than credit cards. A financial obligation consolidation financing may be a choice to consider if your monthly settlements are feeling means as well high. When you obtain a new finance, you can prolong the term length to reduce exactly how much you pay on a monthly basis.

About Federated Funding Partners

This is because individuals can save a considerable quantity by settling their high rate of interest credit report card financial obligation with a new lower-interest lending. There are many financial institutions, credit history unions, as well as online lenders that provide lendings for settling financial obligation.

Generally, individuals seeking financial debt consolidation financings have several resources of financial obligation as well as wish to accomplish 2 things: First, lower their passion rateand thus pay much less each monthand moved here reduce the quantity they need to pay over the life of their funding. Second, they are trying to merge numerous car loans right into one, making it easier to track month-to-month payments.

Federated Funding Partners Bbb Fundamentals Explained

An additional option is to choose a shorter payment term, which reduces the repayment duration as well as to aid obtain the consumer out of debt faster. For instance, state a debtor has $10,000 on a credit card, paying 20% in interest, and the minimum payment is 4%. If they pay the minimum declaration equilibrium monthly, it would take 171 months, or 14 years and three months, to pay it back.

36 in interest. But if you consolidate that debt with a brand-new loan that has an 8% rate of interest and also a 10-year term, you will certainly pay $4,559. 31 in rate of interest. Not only would you conserve money in interest by consolidating your charge card debt, but you can possibly boost your credit rating by repaying your combined funding in a timely manner.